About Us

Private credit manager providing capital for sectors critical to U.S. national and economic security

Rochefort Asset Management is a joint venture between Hayman Capital Management and Serengeti Asset Management, created to participate in the new Critical Technologies Initiative (CTI). The CTI combines the Small Business Administration’s experience in executing their highly successful programs with the U.S. Department of Defense (DoD) and its Office of Strategic Capital’s robust scientific and technical expertise and national security mission.

Hayman was formed in December 2005 by Kyle Bass and has an eighteen-year track record of investing in global event driven themes across multiple sectors. Due to Kyle’s in-depth research regarding the Chinese economy, the Chinese architecture of their financial system, and geopolitical influences in China, he has become a leading private sector subject matter expert (SME) on China. As an SME on China Mr. Bass has been asked to speak to senior members of the US military, numerous college classes throughout the country, and various international media outlets.

Our Approach

Settled Science

Identify companies with “settled science” that have demonstrated commercial viability through recurring revenue, contracted agreements, and consistent gross margin performance, requiring capital to scale

Transformation

Enables companies to execute their business plans, positioning them for future financing through more traditional funding sources

Senior Secured Loans

Structure medium-term senior secured loans that are firmly tied to the enterprise and overcollateralized by revenue, assets, and overall enterprise value for security

Maximize Value

Leverage our financial, industry, operational, and legal expertise to maximize the value of our portfolio companies

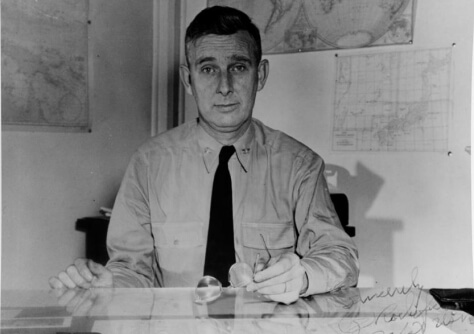

Origins of Our Name

Joseph J. Rochefort played a pivotal role during WWII when he broke Japanese naval attack codes during the Battle of Midway, alerting leadership to an imminent attack. His intelligence work helped the US ambush and destroy four Japanese carrier strike groups, preventing the loss of three American groups, ultimately shifting the war in the Pacific. Rochefort displayed extraordinary courage by convincing leadership to send a deceptive, unencrypted SOS message that tricked the Japanese navy.

In honor of his bravery and foresight, we name our company after Rochefort, symbolizing our commitment to resilience and strategic innovation.

Get in touch

Enlisting policymakers, entrepreneurs, and inventors to our network.

Sign up to learn how you can get involved.